What is Venmo?

Venmo is a popular cash transfer app with over 60 million users. Owned by Paypal, it allows people to send and receive payments without sharing bank details. Originally a peer-to-peer (P2P) payment app, Venmo has evolved into a versatile payment platform used by both individuals and businesses.

Founded in 2009, the Venmo app quickly gained popularity due to its unique social feed. This feature shows users’ transaction details (excluding amounts) in a social media-style feed, allowing friends to view and comment on each other’s payments.

You can use Venmo to:

-

Split bills or settle debts with friends.

-

Purchase goods and services.

-

Interact with friends’ activity updates via a social media-style timeline.

-

Shop on authorized merchant websites, apps, or business profiles.

-

Send donations and gifts.

-

Buy and sell cryptocurrency.

Venmo is known for its social media-style feed.

Venmo is known for its social media-style feed.

How does Venmo work?

Venmo uses P2P technology to enable direct money transfers between users, eliminating the need for traditional bank intermediaries. Payments can be funded through linked debit or credit cards or Venmo balances. Users can also transfer their Venmo balance to a linked bank account.

Here’s how to set up and use Venmo:

-

Create an account in the Venmo app or via a secure web browser.

-

Add your expenses and split costs among group members (if needed).

-

When it’s time to settle, tap Pay or Request.

-

Venmo will handle the calculations to ensure everyone pays their share.

You can also sync your phone contacts or link your Facebook account to share your transactions on the Venmo social feed, which you can make public or friends-only. This allows you to react to your friends’ transactions by liking, commenting, or sending emojis.

Another popular feature of Venmo is the option to send messages, which can make splitting bills and asking for money feel a little less transactional.

Is Venmo legit?

Venmo is a legitimate and secure payment platform. It uses SSL certificates for encryption and multi-factor authentication to protect accounts. Venmo also monitors account activity to identify unauthorized transactions and combat fraud. However, it's a good idea to make your transactions private to prevent others from viewing your payment activities and contacts.

Is Venmo safe to use?

Venmo is safe to use when interacting with people you know and trust, but much less so with strangers. Venmo has security features in place to authenticate users and keep transactions secure, but scammers can make fake Venmo accounts to trick others into unsafe transactions.

Venmo is relatively safe for buying goods and services, though it offers less protection than other payment methods. Its Purchase Protection Program covers certain eligible transactions, including payments marked as goods and services, business profile transactions, and authorized merchant payments, but does not cover payments to personal accounts.

Venmo is also generally safe for sellers looking to do legitimate business, as the Venmo policy prevents buyers from easily canceling a payment once it’s sent. This feature is designed to reduce the risk of buyers reversing payments after they receive the goods or services.

Venmo’s safety credentials

Venmo uses a range of security protocols and safety features to help protect its users, including:

Use two-factor authentication to help prevent Venmo fraud.

Use two-factor authentication to help prevent Venmo fraud.

Risks of using Venmo

Using Venmo comes with some financial and privacy risks. This includes payment scams, phishing attacks, and hacking. One of the cons of using Venmo is that your public transactions are visible to others, potentially exposing sensitive information.

Venmo’s Trustpilot reviews highlight concerns about fraud prevention and buyer protection. Users report difficulties obtaining refunds and frustration with unresponsive customer service, making dispute resolution challenging. Many also feel the platform’s fraud protections are insufficient, especially for buyers.

Venmo’s TrustPilot ratings are low.

Venmo’s TrustPilot ratings are low.

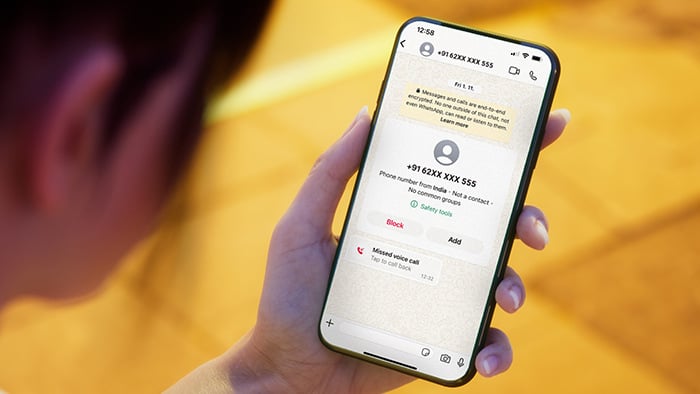

Phishing

Phishing is a potential risk when using Venmo, both within and outside the app. Scammers use social engineering techniques such as deceptive emails, texts, or Venmo’s social features to steal login credentials or financial information. These attacks often involve fake payment requests or links to fraudulent websites designed to capture sensitive data.

Here are just a few examples of Venmo phishing risks:

-

2FA scams: Scammers may impersonate Venmo, sending fake multi-factor authentication emails or text messages with links to phishing sites in an attempt to steal your password, Social Security number, or financial information.

-

Customer support impersonation: Cybercriminals pose as Venmo support using a fake customer service number. They may claim there’s an issue with your account and direct you to send money to another Venmo user for a fake verification.

-

Fake sweepstakes: These emails may claim you’ve won money and include a link prompting you to sign in or enter your account details.

-

Quishing: In QR code phishing, or quishing, scammers send fake QR codes claiming to offer promotions or payments. When scanned, these codes direct users to malicious websites or allow hackers to steal login details via keylogger software.

Example of a Venmo phishing message.

Example of a Venmo phishing message.

Hacks

Hackers may be able to compromise your Venmo account, especially if the app experiences a data breach, or if you have re-used your password on other accounts hackers have gained access to. Making your transactions public may also attract unwanted attention from hackers or scammers.

Here’s what to watch out for to stay safer from hackers:

-

Public transactions: By default, Venmo makes your payments public, allowing anyone to view transaction details in the app’s social feed. This can expose you to targeted phishing attacks.

-

Data breaches: In June 2018, malicious actors exploited Venmo vulnerabilities, impacting data related to 200 million Venmo payment transactions.

-

Re-used passwords: Venmo has rules to ensure your password is strong. However, if you’re using the same passwords across multiple accounts, you’re putting your finances at risk.

Scams

Scammers exploit Venmo users through various deceptive tactics to steal money or personal information. Some of the most common Venmo cash scams are:

-

Fast money offers: A scammer promises you a large return for a small upfront payment. They may pose as a stranger or even pretend to be someone you know.

-

Stranger payment scams: A scammer sends you money “by mistake” and then asks you to return it as a new payment. The original transaction is often made with a stolen card or hacked account, while you lose the refunded amount.

-

Fake or faulty product scams: This is when scammers sell counterfeit items or gift cards that you believe are legitimate on platforms like Facebook Marketplace, but you receive something different from what was advertised, leaving you out of pocket.

-

Impersonation scams: Using the information from your Venmo public feed, a scammer can pose as a friend or family member before asking for more personal information or money.

-

Overpayment scams: A fake buyer “accidentally” overpays for an item and asks for a refund. After you send the refund, the original payment is reversed, leaving you (the seller) at a loss.

Example of an overpayment scam message.

Example of an overpayment scam message.

How to use Venmo safely

To protect yourself from scams and fraud on Venmo, it’s important to be proactive. Key methods for avoiding Venmo scams include enabling 2FA to secure your account, only exchanging payments with trusted users, and regularly monitoring your transactions to catch any suspicious activity early.

Here’s how to use Venmo safely:

-

Only exchange payments with trusted users: Stick to friends, family, and businesses with official verification badges (the blue tick).

-

Avoid suspicious links and messages: Don’t click unknown links in emails or texts, and verify messages claiming to be from Venmo.

-

Adjust your privacy settings: Make your Venmo profile private to limit who sees your transactions on your social feed.

-

Enable security features: Set up 2FA and fraud alerts on your accounts.

-

Keep your personal information private: Never share passwords, account details, or security codes. Enter sensitive info only within Venmo’s official app or website.

-

Use a credit card instead of a debit card: Credit cards offer better fraud protection with zero liability, fraud alerts, and easier dispute resolution compared to debit cards.

-

Tag personal Venmo payments before sending: Mark transactions correctly to prevent disputes by selecting the appropriate category, such as “Payment” or “Gift.”

-

Monitor your accounts regularly: Check your bank statements and Venmo transaction history for unauthorized activity.

-

Wait for payment before shipping your items: Never send goods until funds are fully verified.

-

Use strong, unique passwords: Avoid reusing passwords and consider a password manager.

-

Keep your device secure: Don’t let strangers access your phone or Venmo account.

-

Use a security app: Keep your device safe when on Venmo by installing a security app, like Avast Mobile Security, to detect malware, phishing attempts, and other security threats.

-

Use a secure browser: If you don’t use the app, access Venmo through an updated, secure browser with HTTPS encryption to protect your login credentials and payment details.

-

Avoid public Wi-Fi: Public networks can make it easier for hackers to intercept your data, login credentials, and payment details. Use a VPN or mobile data for a safer connection when using Venmo.

-

Contact Venmo through official channels: Reach out only via the official website, app, or social media accounts to prevent refund scams and other security threats.

What to do if you get scammed on Venmo

If you’ve fallen victim to a Venmo scam or hack, act quickly to secure your account and report the issue. Here’s what to do:

-

Contact your bank or credit providers: Notify your bank about the scam so they can freeze your accounts or set up alerts for suspicious activities. They may also provide guidance on how to recover lost funds.

-

File for Venmo Purchase Protection: Submit a ticket through the app or online with payment details and the recipient’s username.

-

Update your Venmo details: Immediately replace your password with a strong, unique one. Remove your linked bank account information until you know your account is secure.

-

Report to Venmo support: Submit a complaint through Venmo’s official support page, including any evidence (screenshots or emails). Forward phishing messages to phishing@venmo.com.

-

Block the Venmo scammer: Go to their profile > Tap the three-dot menu > Block. You need to log out and in again to activate the block. Take screenshots of the scam before you block the user.

-

Inform the Federal Trade Commission: Filing a report with the FTC will assist in wider investigations into Venmo fraud and scams. If you’re the victim of identity theft, also report the incident to the official government Identity Theft website.

-

Run a malware scan: Check for evidence of spyware, viruses, or signs of phone hacking using reliable virus-scanning software.

Safeguard your privacy with Avast

Venmo has strong security features, like encryption and multi-factor authentication, but in the end, its safety depends on how its users interact with the platform.

Help protect your hard-earned funds from hackers with Avast Free Antivirus, offering cutting-edge, AI-powered defense against malware, scams, and other online threats — 24/7. Plus, get Hack Alert notifications if compromised passwords linked to your email are found, giving you the opportunity to act quickly and safeguard your accounts.